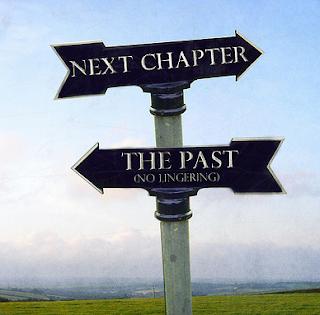

What's Next?

The financial services industry is going through a

significant transition. This is

especially noticeable in the wealth management segment, which is feeling the

triple impact of breakaway advisors, management restructuring and the DOL. The needed changes will affect clients,

advisors and management professionals.

Hopefully it can be an improvement for them all. It has taken me over six months since

my January blog to realize that embracing these changes could be beneficial for us

all. We all should be asking

ourselves “What’s Next?”

Managers

The

robo advisors and ETFs have staked their claim that active money managers and

human advisors are flawed and best managed by computer algorithms. Human advisors and managers need to kick

the computer’s butt (assuming they have a butt). As professional management transitions from conflicted business

models that need managers to drive sales goals of proprietary products managers must retool and understand how

to help independent advisors. To

date many independent firms have created their own products and managers need

to advise against making the same mistakes of our old firms. We can do better than pass-trough

vehicles, institutional consultants, TAMPS and exclusively hiring professionals

from our old firm.

Advisors

While

advisors have made the important decision to break away they still need to make

a few more decisions. First they

must decide on what they want to build.

A business that will create significant franchise value or one that keeps

doing what they have always done without the burden and financial tax of their

previous firm. I don’t believe

there is one right answer. Each decision

will require different staffing and have different profit margins. They will also have significantly

different terminal values. To eliminate

any confusion the press assumes we all want to breakaway and build a business. Fake News?

So What’s Next?

A new and improved business model that is a dramatic

improvement on the current providers.

We have numerous free tools at our disposal to help us build a better mousetrap

and create an enduring culture.

Podcasts and MOOCs are a good place to start. Clients have initially voted with their assets that the

unconflicted Fiduciary model is preferable. We are at square one and need to continue to improve. The good news is no independent firm

has figured this out yet…

Comments

Post a Comment