Independent RIA Bill of Rights

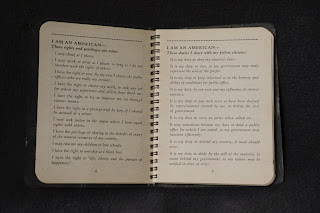

Our independent wealth advisory business needs a Bill of Rights. This week we will examine the essential elements of our country’s Bill of Rights and use that template as our guide. It will be a difficult process, but nothing that lasts is easy. Our founding fathers didn’t all agree. Our wealth advisory leaders don’t see eye to eye either. We will examine similarities that worked and conflicts that are inevitable. The three themes we will examine are a good start, but they don’t solve all of our challenges. Our starting place is we both aren’t satisfied with the status quo. We also are both scholarly. The final item is our flexible structure. We won’t get it all right at first so we need to pass amendments. Let’s get to work.

Our founding fathers were frustrated with the king. Most independent advisors are frustrated with their old boss. Most investors are frustrated with their investment managers. When our frustration reaches a tipping point we have to change. While we don’t need to risk our life on a transatlantic ship we will need a map to guide us. Emotions can only take us so far before they start to fade. Our Bill of Rights can remind us why we changed.

Most of our founding fathers were lifelong learners. Their education allowed them to write down what they wanted to change. We still reference their writing and try to adhere to the constitution and the bill of rights. Their educated opinions are essential to the enduring nature of writing. While they were a educated group they didn’t agree on everything. Their common beliefs and the written opinions helped them solve disagreements and it still helps us over two hundred years later. Our independent advisors have different opinions too. Our Bill of Rights will help us and our clients solve most arguments.

Comments

Post a Comment